Policy Briefings

Policy Brief – May 14, 2024

Summary USDA announces three additional consultations scheduled during the first week of June at NCAI mid-year to discuss self-determination policies in forestry, food safety, and nutrition programs. IFAI will facilitate an online Tribal caucus with partners on May...

Policy Brief – May 7, 2024

Summary USDA announces three additional consultations taking place the first week of June at NCAI mid-year to discuss self-determination policies in forestry, food safety and nutrition programs. IFAI will facilitate a Tribal caucus with partners on May 23, 2024...

Policy Brief – April 30, 2024

Summary The Minority Business Development Agency will hold consultations on May 17 about their business development and entrepreneurial services in Indian Country. USDA has consultations on Build America Buy America Act impacts on Tribal on May 22-23. There were...

Native Farm Bill Coalition

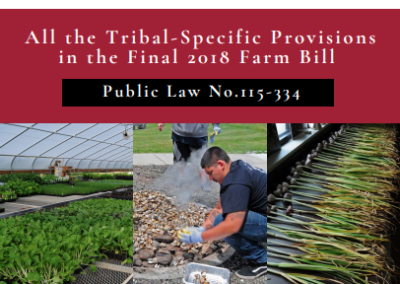

The Farm Bill is a large piece of legislation that passes every five years, and it determines funding for USDA programs. It typically includes 12 separate titles focused on everything from nutrition to crop insurance, and has a profound impact on Indian Country.

The Native Farm Bill Coalition (NFBC) brings together the voices of Tribes, intertribal organizations, other Native organizations and non-Native allies around the country to advocate with a strong, unified voice in Washington, D.C., to advance investments in Native agricultural production, rural infrastructure, economic development, conservation, and forestry.

The Native Farm Bill Coalition was formed in 2017 ahead of the 2018 the largest-ever coordinated effort in Indian County around federal food, agriculture, and nutrition policy. The NFBC was co-founded by the Shakopee Mdewakanton Sioux Community (SMSC), the Intertribal Agriculture Council (IAC), the National Congress of American Indians (NCAI), and the Indigenous Food and Agriculture Initiative (IFAI) as the Coalition’s official research partner. Learn more about the Native Farm Bill Coalition at www.nativefarmbill.com.

Approximately every five years, Congress passes a new Farm Bill that sets programs, funding, and eligibility for U.S. Department of Agriculture programs. These programs impact nutrition, farming, ranching, and production, rural development, utility and internet access, and more across the U.S., Indian Country included.

IFAI’s curated tracker offers an analysis of the 2018 Farm Bill’s Indian Country-specific provisions and offers a look at opportunities for Indian Country agriculture in the next Farm Bill.

Click the button below to access IFAI’s tracker.

Please note, this is a living resource that IFAI updates frequently.

Recent Publications and Infographics

Publications & Infographics – 2013 – 2022

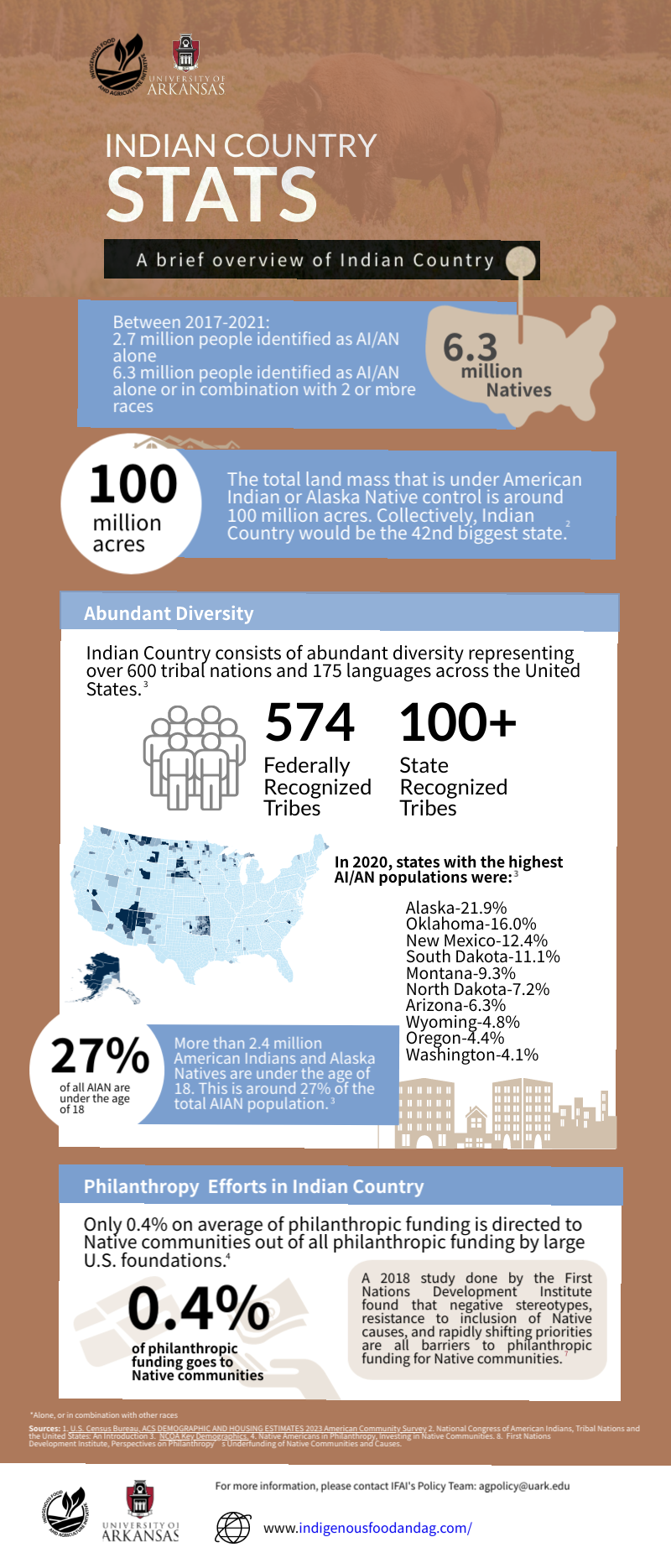

Indian Country Stats - A Brief overview of Indian Country

Reimagining Hunger Responses in Times of Crisis

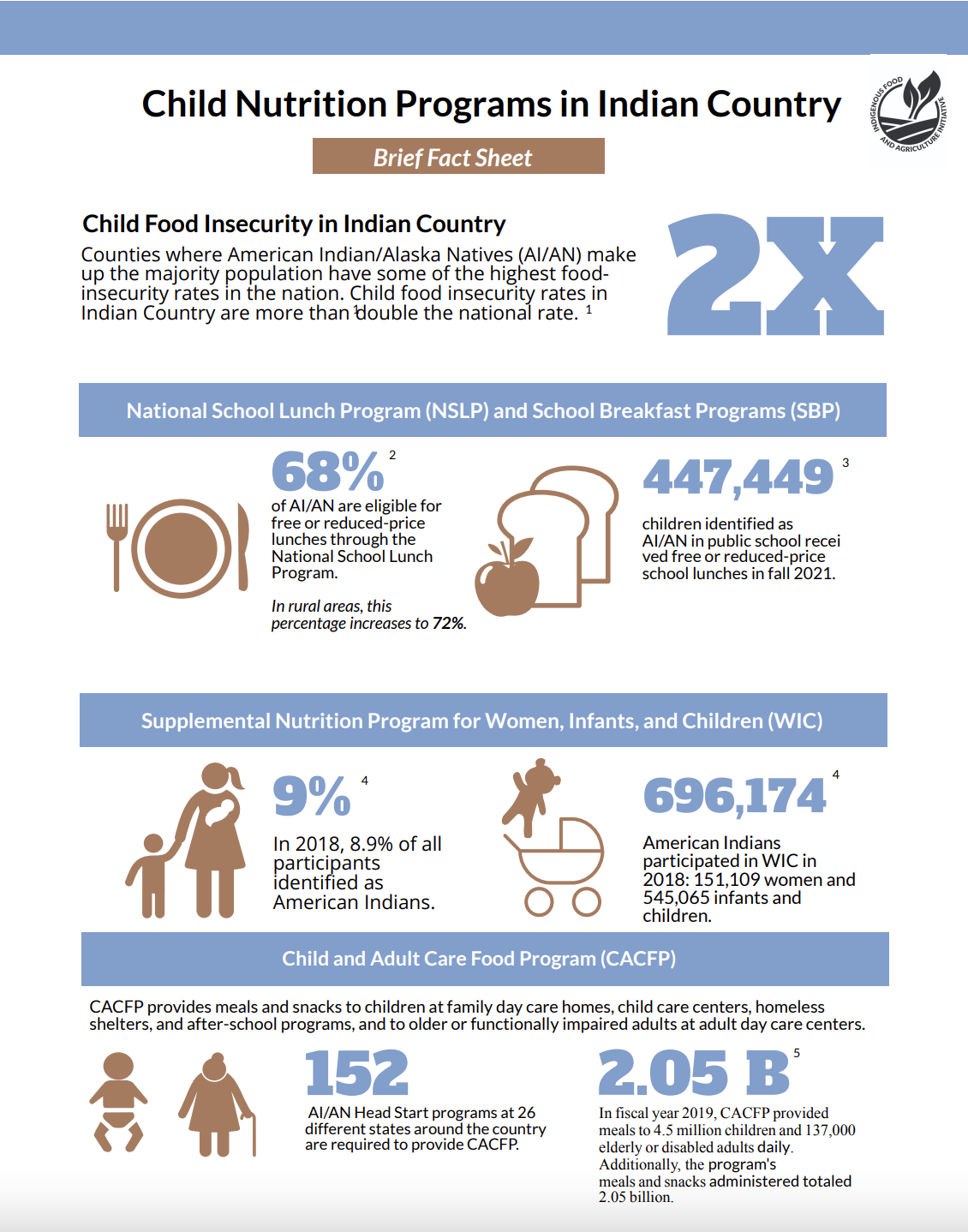

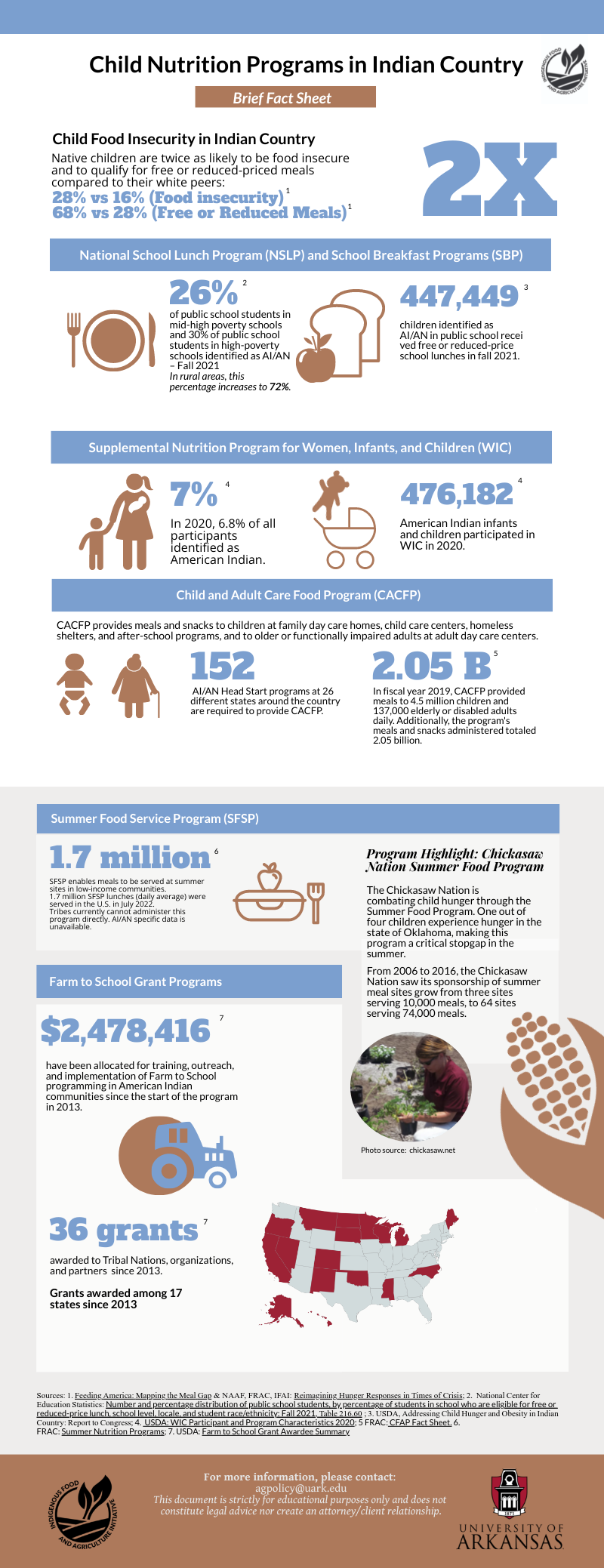

Child Nutrition Programs in Indian Country

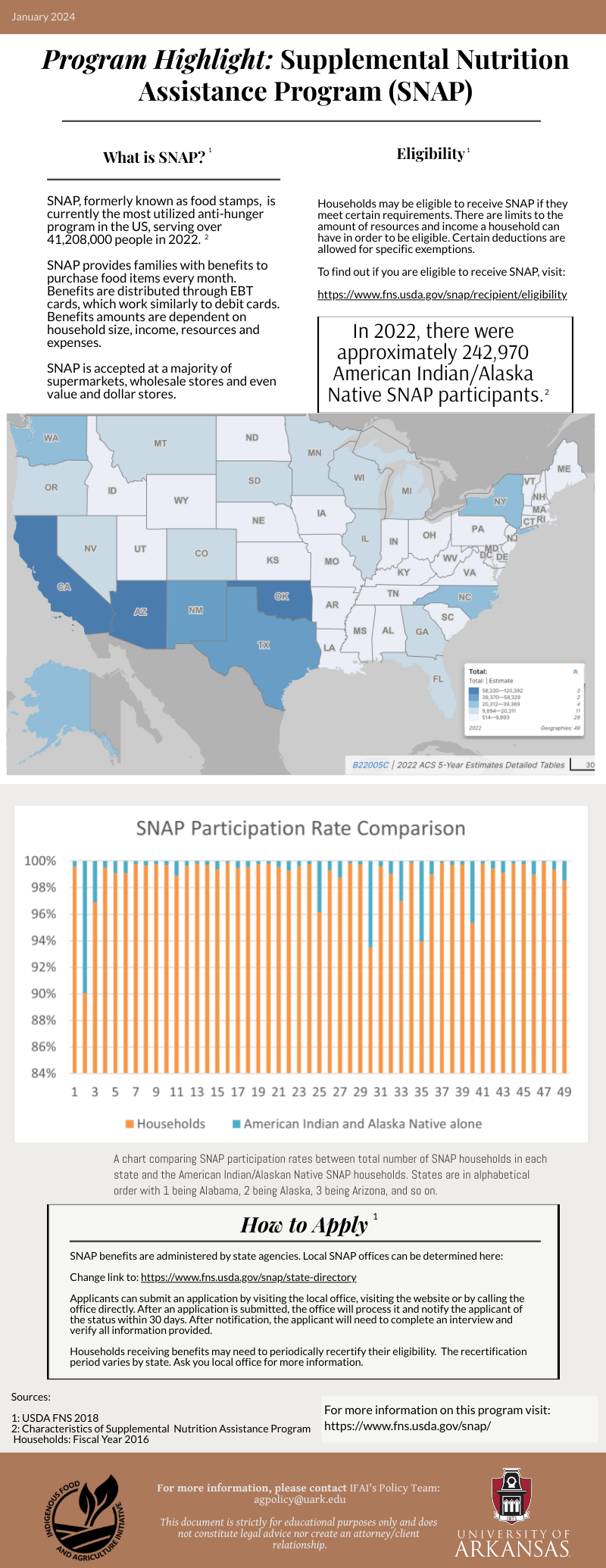

SNAP Highlights

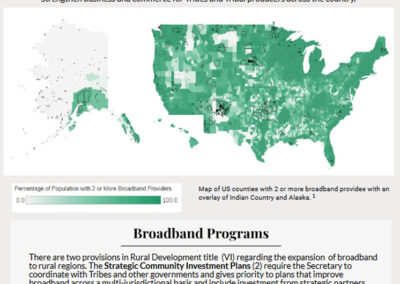

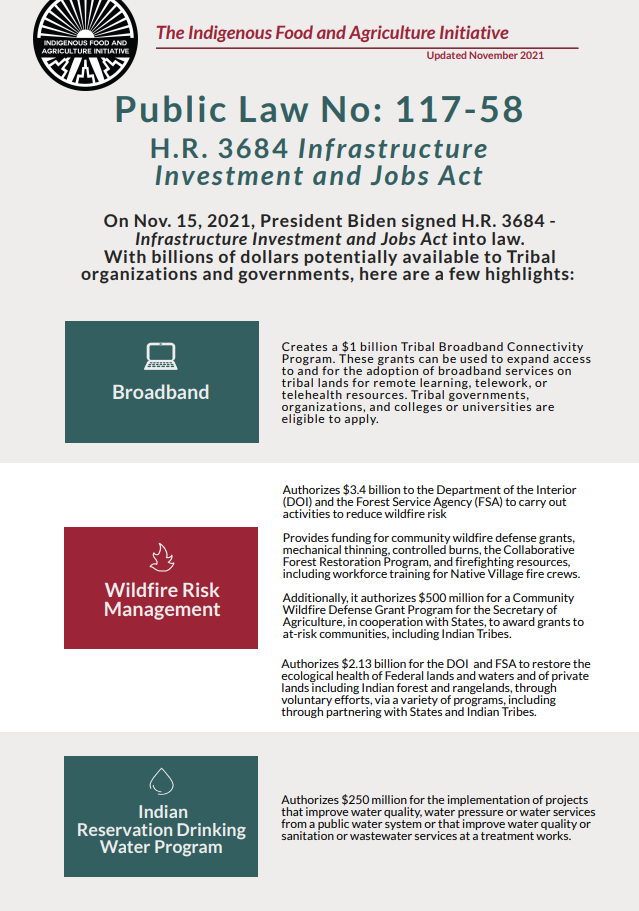

Public Law No: 117 - 58

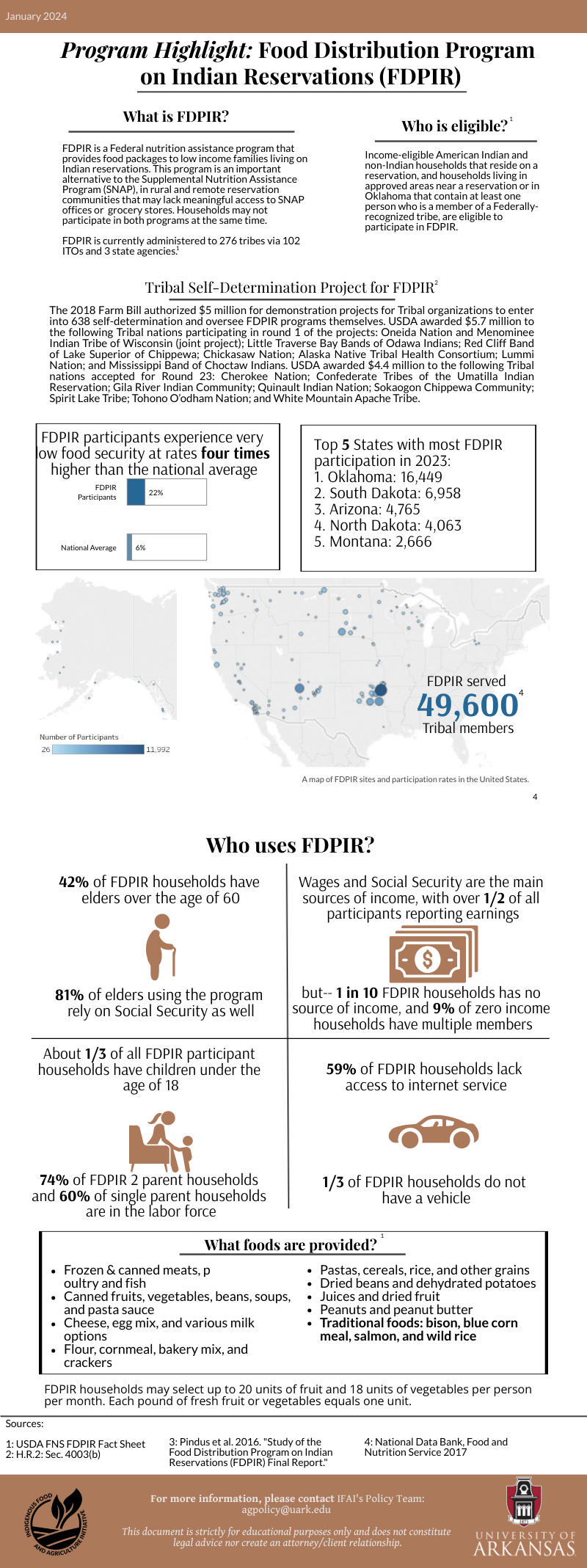

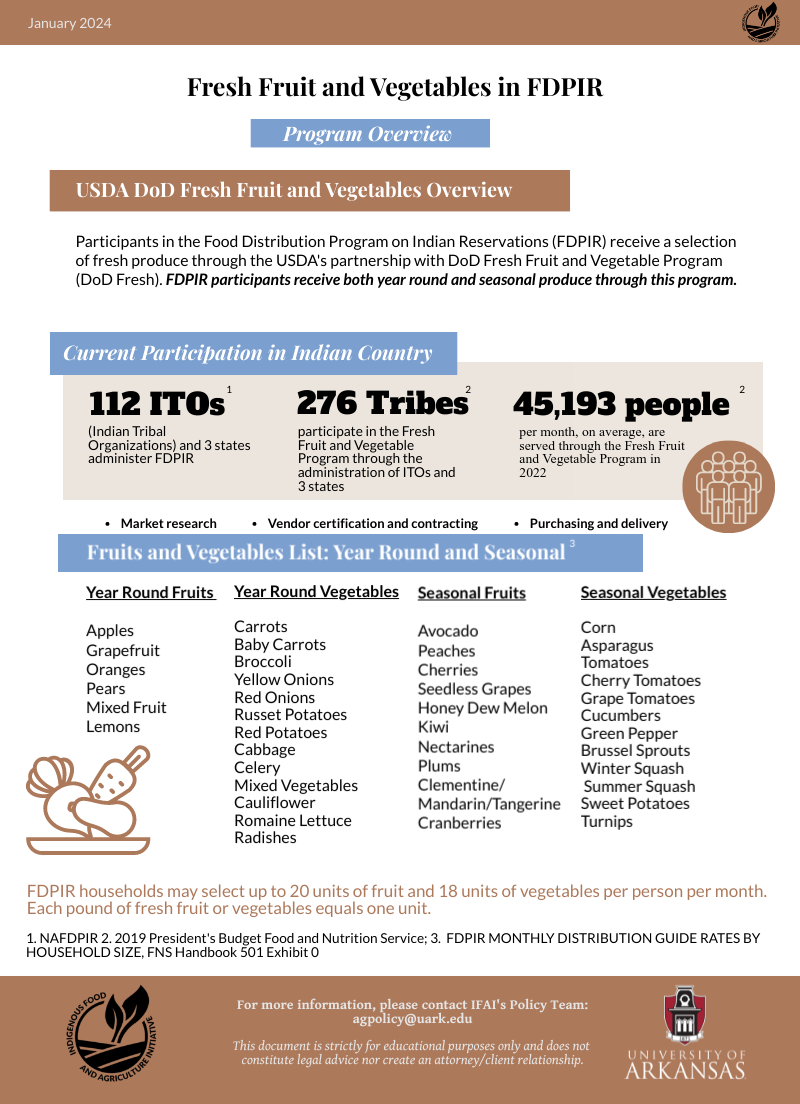

Food Distribution Program on Indian Reservations

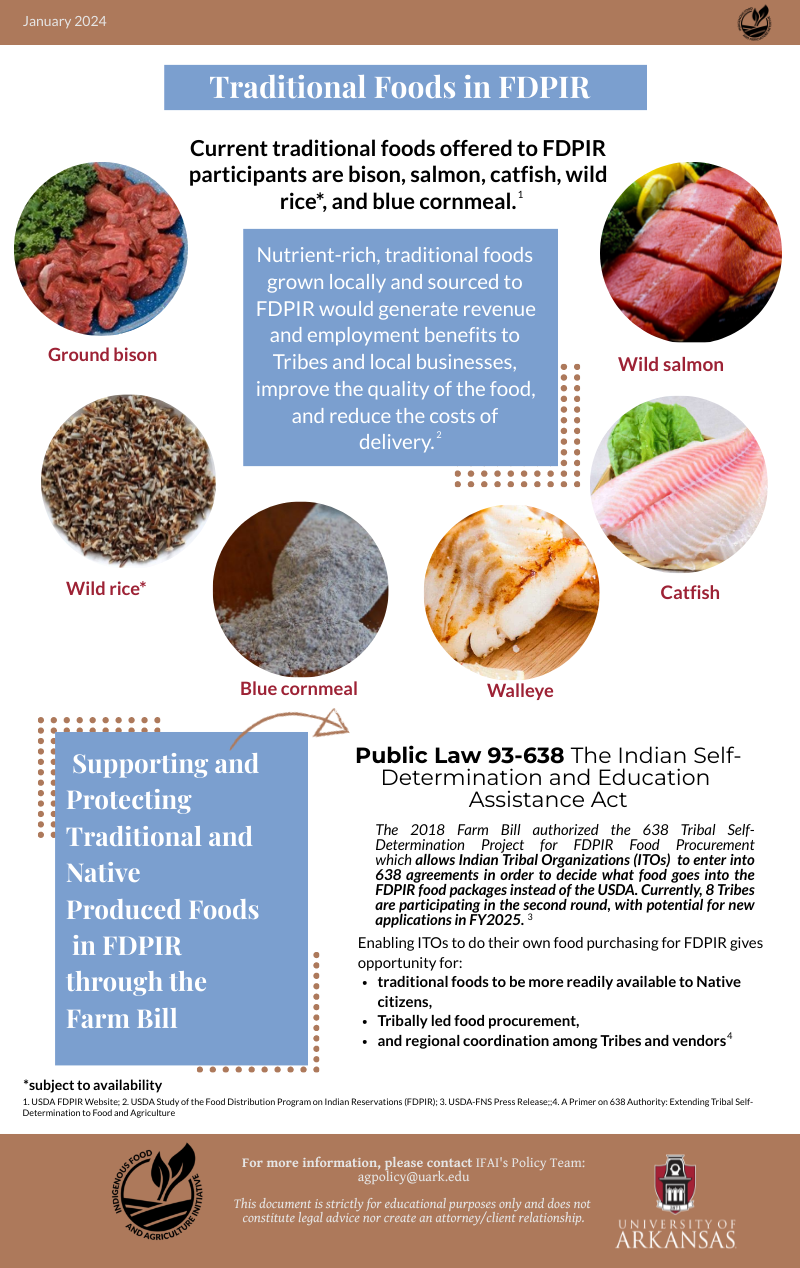

Traditional Foods in FDPIR

Intertribal Food Systems Report

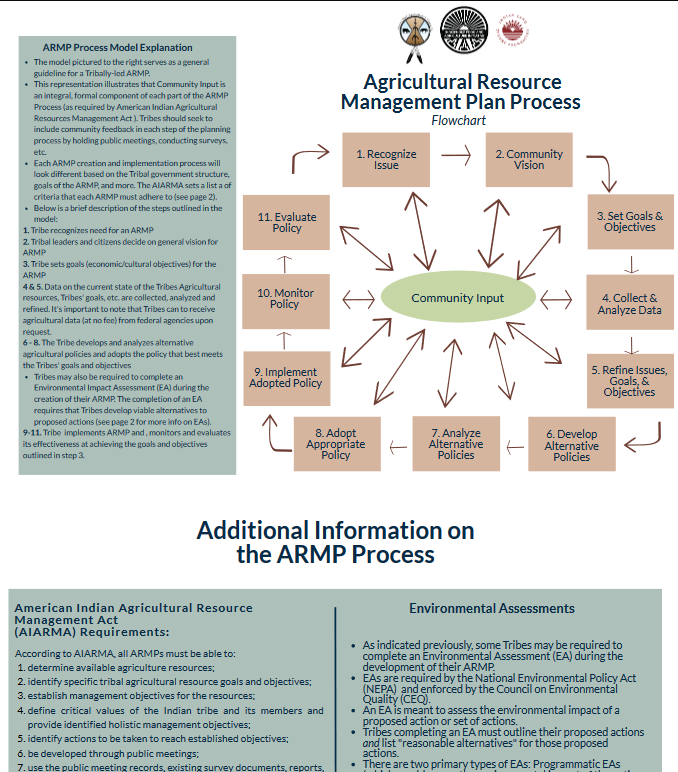

Agricultural Resource Management Plan Process

Child Nutrition Facts

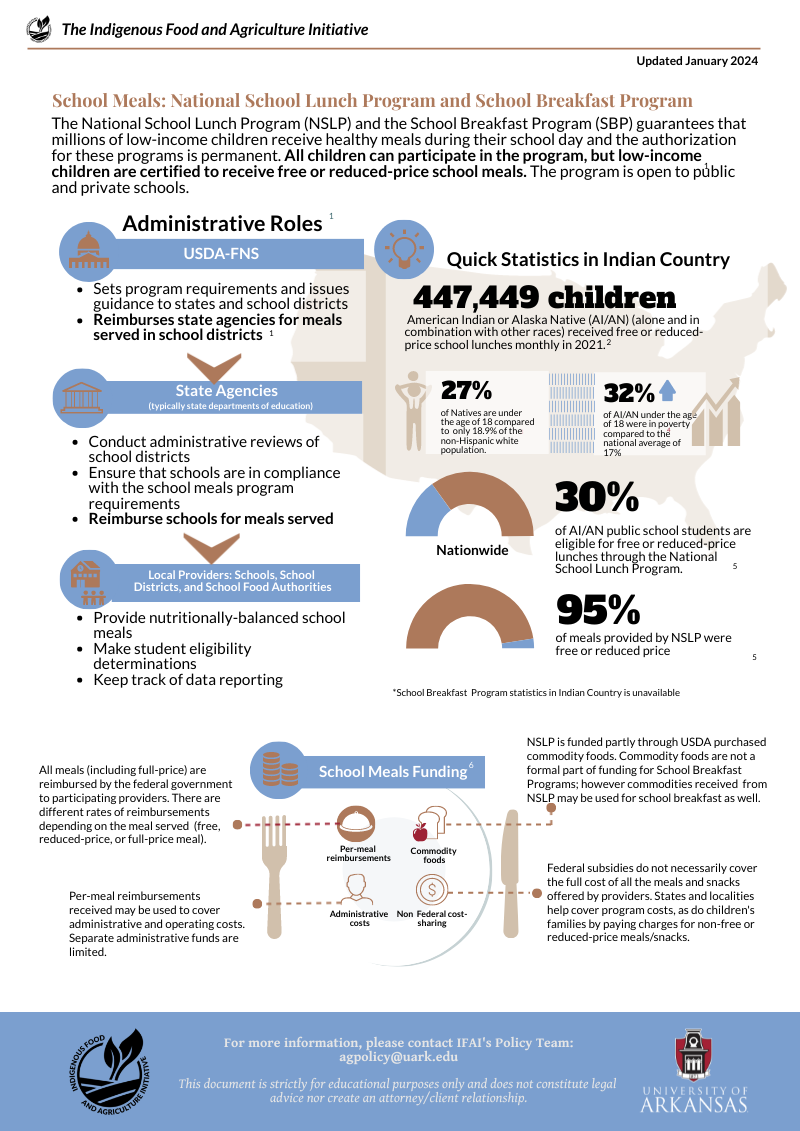

School Meals: National School Lunch Program and School Breakfast Program

Fresh Fruit and Vegetables Program in Schools

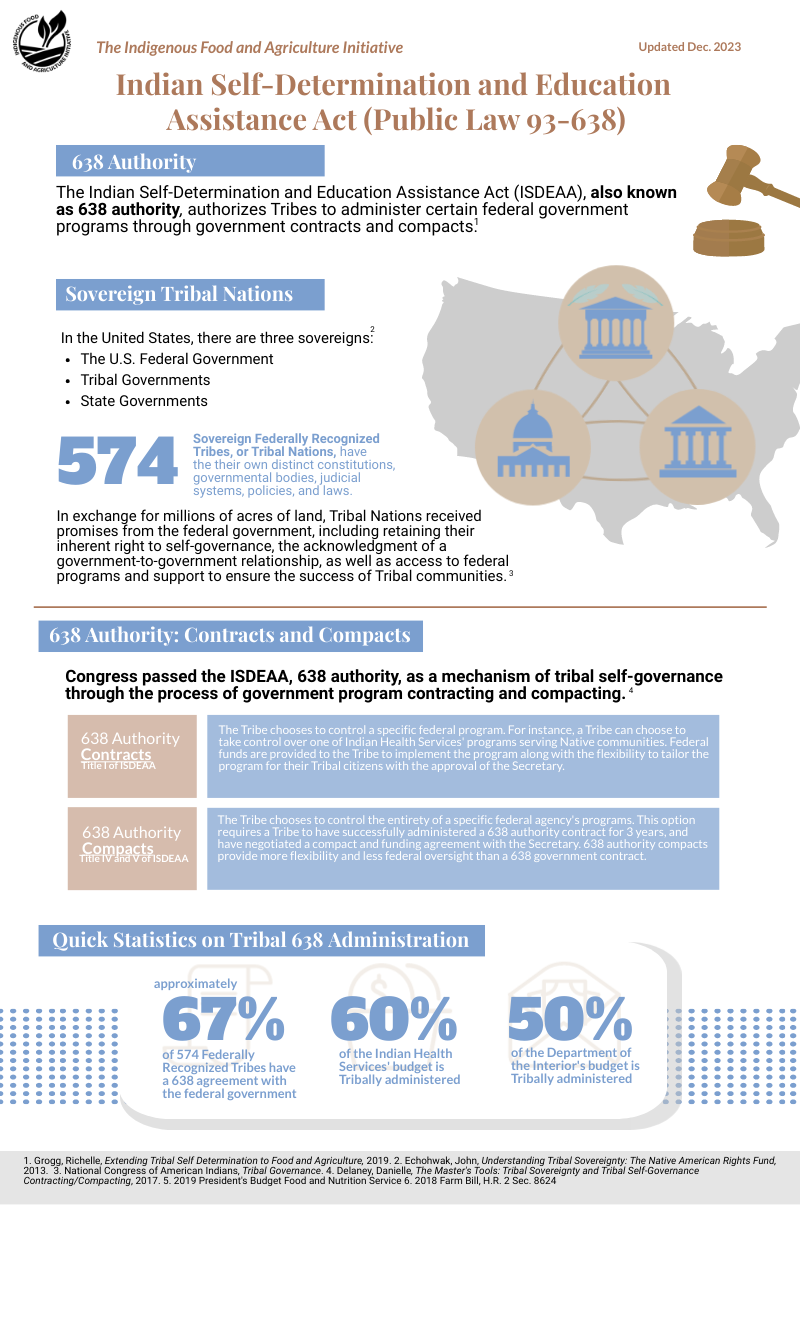

Indian Self-Determination and Education Assistance Act (Public Law 93-638)

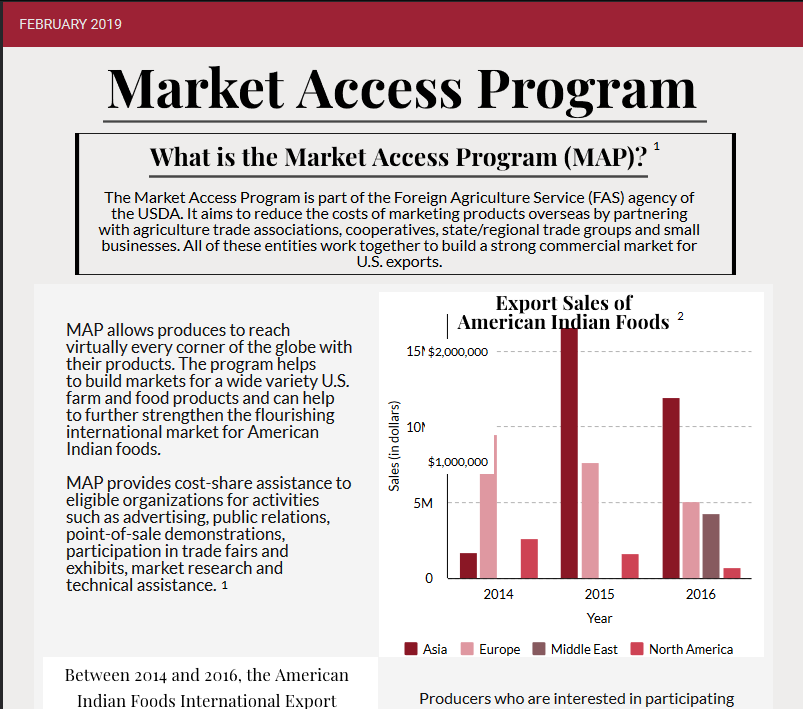

Market Access Program

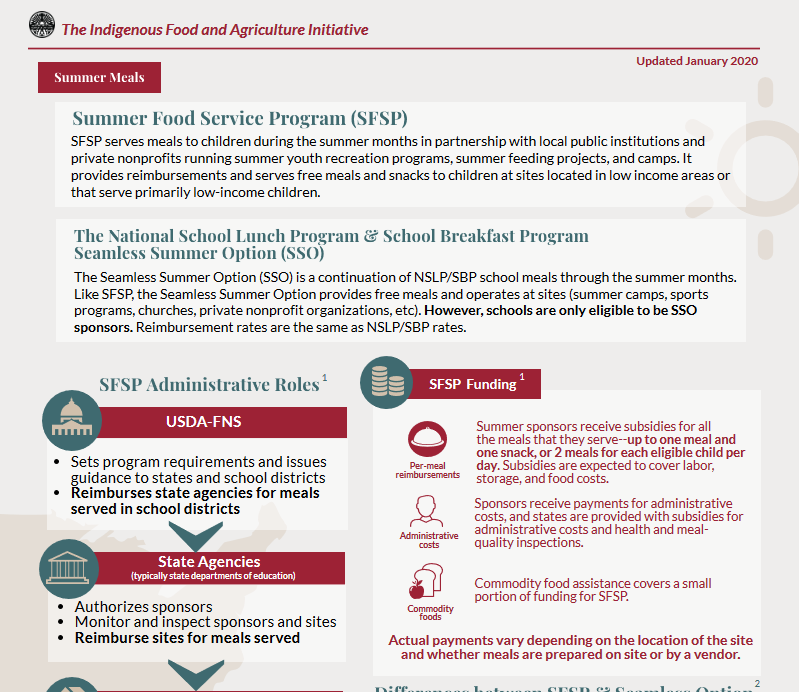

Summer Food Service Program (SFSP)

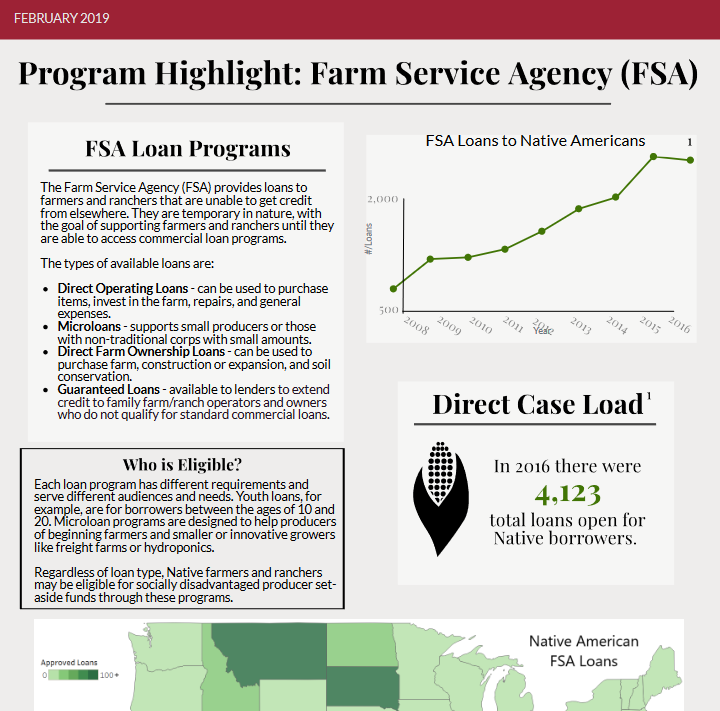

Program Highlight: Farm Service Agency (FSA)

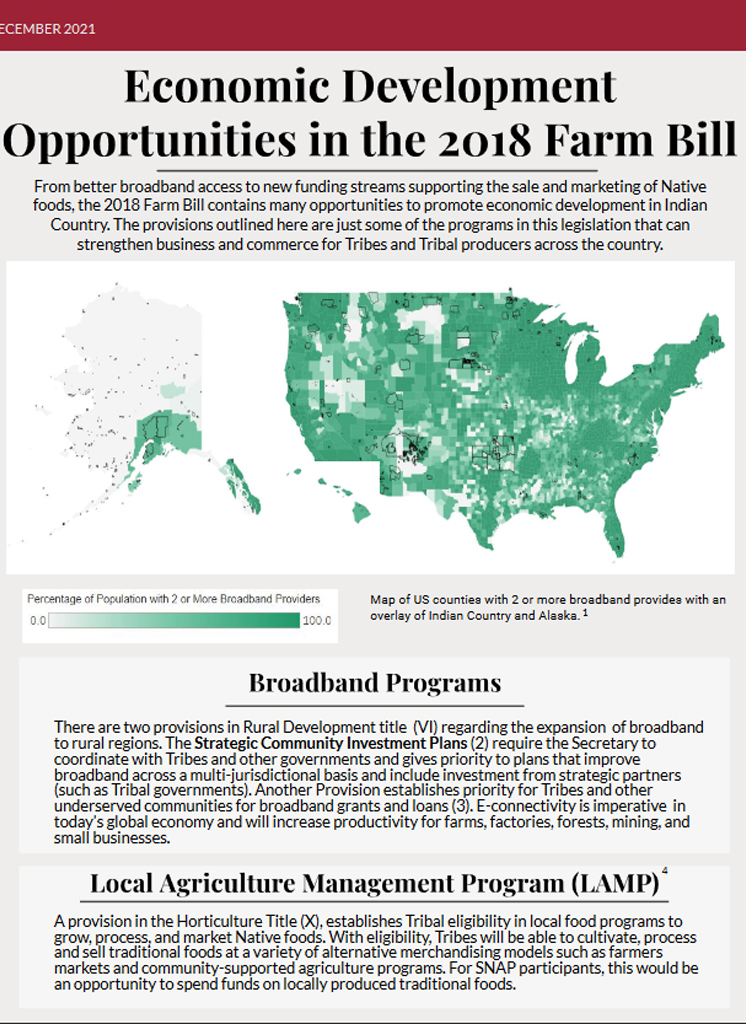

Economic Development Opportunities in the 2018 Farm Bill

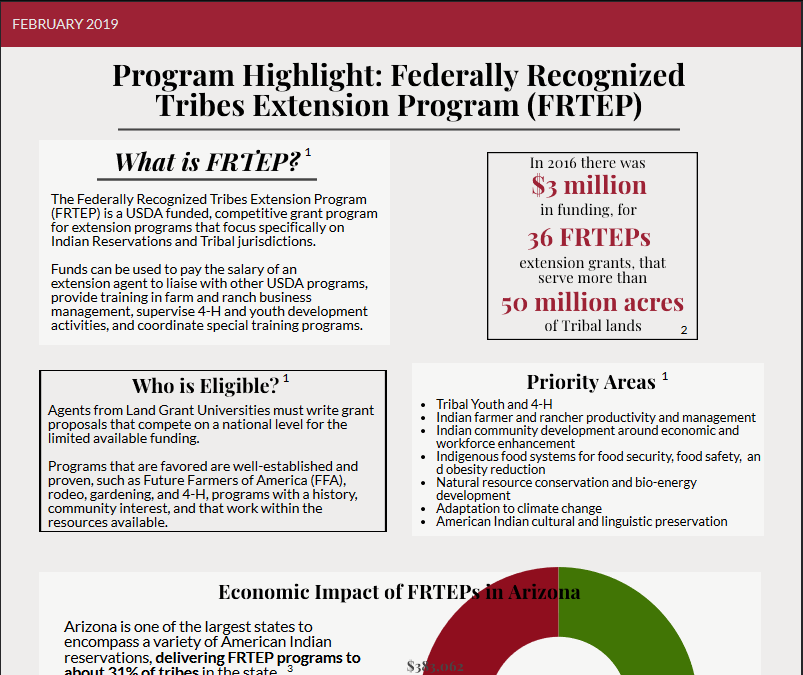

Program Highlight: Federally Recognized Tribes Extension Program (FRTEP)

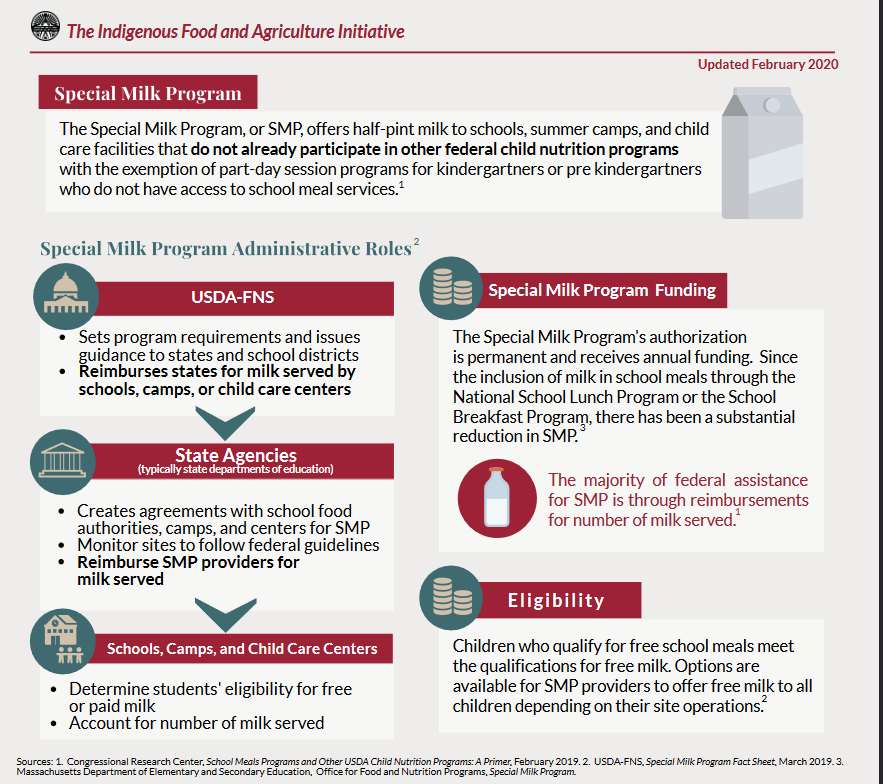

Special Milk Program

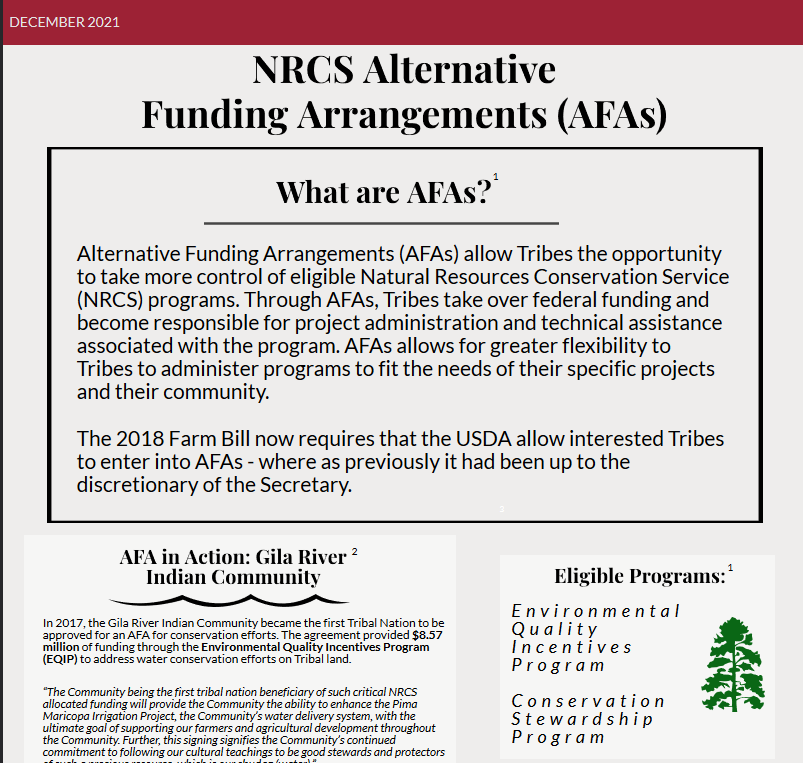

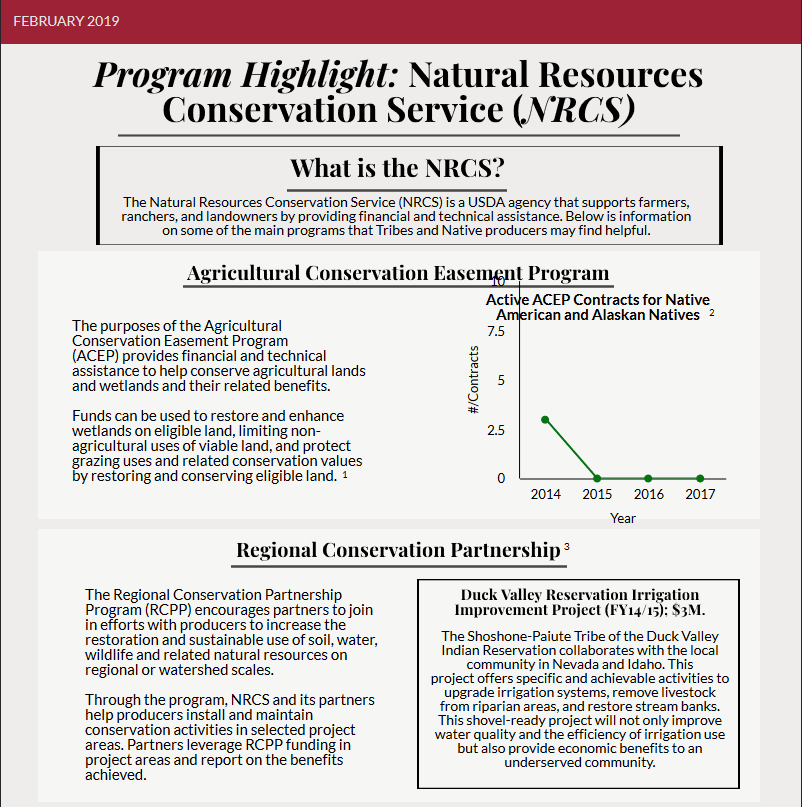

NRCS Alternative Funding Arrangements (AFAs)

Program Highlight: Natural Resources Conservation Service

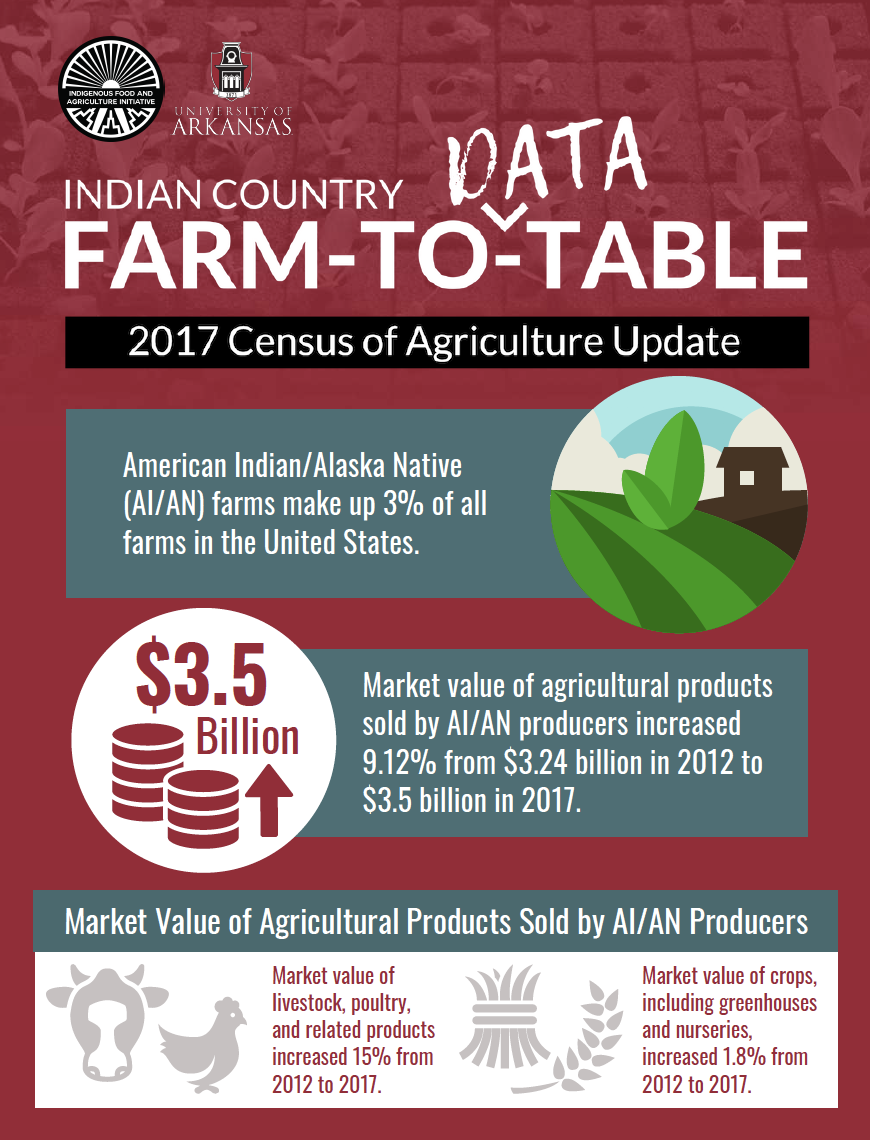

2017 Census of Agriculture Update

Policy Analysis

The 2018 Farm Bill and the Legal Landscape for Industrial Hemp Production in Indian Country

Regaining Our Future: An Assessment of Risks and Opportunities for Native Communities in the 2018 Farm Bill

Jamie Simms Hipp & Colby D. Duren (2018)

Optimizing Distribution Center Location and Delivery Schemes for the USDA's Food Distribution Program on Indian Reservations (FDPIR)

Karli Moore, Et Al. (2018)

Building Indian Country's Future Through Food, Agriculture, Infrastructure, and Economic Development in the 2018 Farm Bill

Janie Simms Hipp, Colby D. Duren, and Erin S. Parker (2018)

Tribal Consultation for Food, Safety, and Trade

Tribal Consultation Farming, Ranching, and Conservation

Creating a Tribal Action Plan for a Fairer, More Competitive and More Resilient Meat and Poultry Supply Chain

Building Indian Country's Future Through Food, Agriculture, Infrastructure, and Economic Development in the 2018 Farm Bill