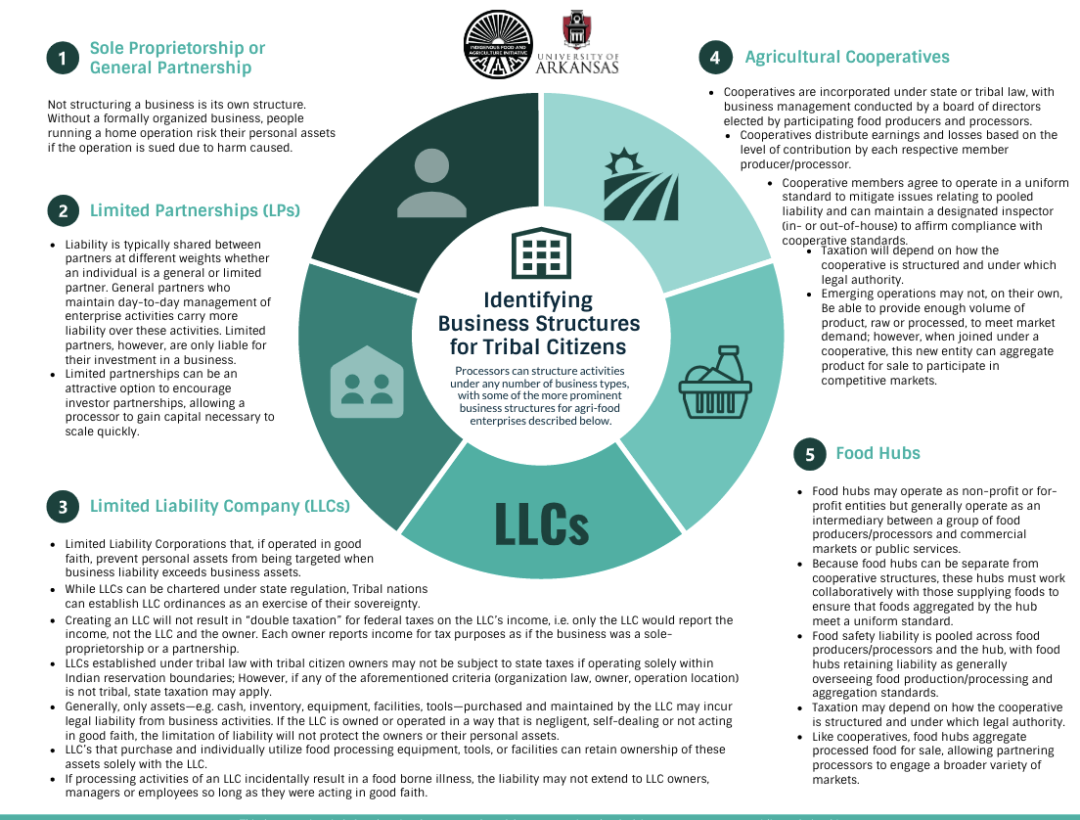

Processors can structure activities under any number of business types, with some of the more prominent business structures for agri-food enterprises described below.

Sole Proprietorship or General Partnership

Not structuring a business is its own structure. Without a formally organized business, people running a home operation risk their personal assets if the operation is sued due to harm caused.

Limited Partnerships (LPs)

- Liability is typically shared between partners at different weights whether an individual is a general or limited partner. General partners who maintain day-to-day management of enterprise activities carry more liability over these activities. Limited partners, however, are only liable for their investment in a business.

- Limited partnerships can be an attractive option to encourage investor partnerships, allowing a processor to gain capital necessary to scale quickly.

Limited Liability Company (LLCs)

- Limited Liability Corporations that, if operated in good faith, prevent personal assets from being targeted when business liability exceeds business assets.

- While LLCs can be chartered under state regulation, Tribal nations can establish LLC ordinances as an exercise of their sovereignty.

- Creating an LLC will not result in “double taxation” for federal taxes on the LLC’s income, i.e. only the LLC would report the income, not the LLC and the owner. Each owner reports income for tax purposes as if the business was a sole proprietorship or a partnership.

- LLCs established under tribal law with tribal citizen owners may not be subject to state taxes if operating solely within Indian reservation boundaries; However, if any of the aforementioned criteria (organization law, owner, operation location) is not tribal, state taxation may apply.

- Generally, only assets—e.g. cash, inventory, equipment, facilities, tools—purchased and maintained by the LLC may incur legal liability from business activities. If the LLC is owned or operated in a way that is negligent, self-dealing or not acting in good faith, the limitation of liability will not protect the owners or their personal assets.

- LLC’s that purchase and individually utilize food processing equipment, tools, or facilities can retain ownership of these assets solely with the LLC.

- If processing activities of an LLC incidentally result in a food borne illness, the liability may not extend to LLC owners, managers or employees so long as they were acting in good faith.

Agricultural Cooperatives

- Cooperatives are incorporated under state or tribal law, with business management conducted by a board of directors elected by participating food producers and processors.

- Cooperatives distribute earnings and losses based on the level of contribution by each respective member producer/processor.

- Cooperative members agree to operate in a uniform standard to mitigate issues relating to pooled liability and can maintain a designated inspector (in- or out-of-house) to affirm compliance with cooperative standards.

- Taxation will depend on how the cooperative is structured and under which legal authority.

- Emerging operations may not, on their own, Be able to provide enough volume of product, raw or processed, to meet market demand; however, when joined under a cooperative, this new entity can aggregate product for sale to participate in competitive markets.

Food Hubs

- Food hubs may operate as non-profit or for profit entities but generally operate as an intermediary between a group of food producers/processors and commercial markets or public services.

- Because food hubs can be separate from cooperative structures, these hubs must work collaboratively with those supplying foods to ensure that foods aggregated by the hub meet a uniform standard.

- Food safety liability is pooled across food producers/processors and the hub, with food hubs retaining liability as generally overseeing food production/processing and aggregation standards.

- Taxation may depend on how the cooperative is structured and under which legal authority.

- Like cooperatives, food hubs aggregate processed food for sale, allowing partnering processors to engage a broader variety of markets.

Growing Indian Country Agriculture Economies

Expanding growing operations to include food processing/manufacturing activities allows Indian Country agriculture economies to retain a greater share of the food dollar, a measure of consumer expenditures across all agri-food activities. This vertical integration increases food growers share of return to approximately 25 cents of each dollar revenue from agri-food activities.

- Commercial kitchen access can be cost prohibitive even if locally available, so food processing may start in home kitchens

- Home processors can increase economic returns with access to the right tools, both regulatory and physical

- Increased capacity to process tribally produced foods will strengthen tribal agriculture economies and consistent access to foods

- Cottage food laws, that provide more flexibility for home kitchens while addressing safety concerns, can ease access to markets for home processors with sales thresholds from $5,000 to $50,000 with incremental regulations increasing compliance requirements, depending upon code provisions

- Tribal Departments of Agriculture can support home operations by providing regulatory oversight and assistance, guidance on business structures, or even aid in off-setting start-up costs

- Establishing a small or home enterprise as a formal business operation, like an LLC, can be an important tool in risk management by limiting liability/exposure to risk and separating personal assets from enterprise-related capital investments

- Cottage food laws do not limit liability of home kitchen sales for damages resulting by consuming these products, such as from adulteration or food born illness

Departments of Agriculture as Food Processing Incubators

Incubation

By recognizing different business structures available to Tribal citizens, Tribal Departments of Agriculture can more effectively conduct regulatory oversight, facilitate technical assistance, and/or provide financial/in-kind support for business entities supporting food access.

- Individual producers and processors establishing their business activities under Tribal law that sell goods outside reservation boundaries may need to register with these corresponding states as a “foreign corporation.” Non-Natives with businesses chartered in another state also need to register as a “foreign corporation” if doing business outside in another state’s jurisdiction.

- As matter of sovereignty, tribes conduct oversight to ensure processors operating above the cottage food code sales threshold are approved, registered, inspected, and operate within a commercial kitchen. Tribes may otherwise partner with the Department of Health and Human Service in auditing operations for compliance with food safety standards.

- Understanding these nuances can help safeguard prospective Tribal businesses from misunderstandings while preserving their business.

Training

Under the Food Safety Modernization Act Preventive Controls for Human Foods rule (PCHF), a private home is not a food processing/manufacturing facility and does not need to comply with this rule or register with FDA. Processors that scale beyond cottage food code thresholds must move operations from their home to a commercial kitchen facility and begin complying with PCHF standards.

These standards include (but are not limited to): requiring at least one supervisor take a training recognized by FDA for this purpose and developing a food safety plan addressing hazard analysis and preventive controls for food safety risks relevant to processing activities.

Oversight

Processors that have sales over cottage food laws thresholds must use a certified and inspected commercial grade kitchen. Commercial kitchen equipment and tools can be costly for smaller scale producers, especially those that are not able to immediately scale up sales to generate additional revenue to cover the costs.

- Public grant funding is limited and often competitive. Even where tribal projects receive an award, grant stipulations may require a match or not allow full coverage of project costs.

- Tribal Departments of Agriculture may invest in a commercial kitchen for tribal use, tribal citizen use or contract use by other food processors. Tribal Departments of Agriculture may recover the costs of investment and operation by:

- Requiring processors to pay membership fees to use the commercial kitchen for limited durations through a flat rate annually, tiered fees based on hours or days of use, or trading an equity state in an operation to the tribe for use of the kitchen, where the tribe would then recover costs by obtaining a percentage of sales.

- Requiring processors pay for use on an hour-by-hour basis.

- Purchasing goods at wholesale price from these processors and moving product through community services, Cstores, and other retail outlets.

- Allowing Tribal citizens to utilize processing assets at no cost by offsetting these expenses elsewhere.

- Tribal Departments of Agriculture may set parameters where processors that have scaled their operation to increase their revenue stream and, ultimately, their profit margin are encouraged or required to purchase their own commercial kitchen facility. This decision may be affected by the utilization rate of the Tribe’s owned processing asset.

Sources:

https://www.bia.gov/as-ia/ieed/division-energy-and-mineral-development/business-development/llc-codes

https://www.irs.gov/pub/irs-tege/tribal_business_structure_handbook.pdf

https://www.bia.gov/sites/bia.gov/files/assets/as-ia/ieed/bia/pdf/idc1-032915.pdf

https://www.rd.usda.gov/programs-services/all-programs/cooperative-services

https://www.fda.gov/regulatory-information/search-fda-guidance-documents/draft-guidance-industry-hazardanalysis-and-risk-based-preventive-controls-human-food

Model Tribal Food Code

This document is strictly for educational purposes only and does not constitute legal advice nor create an attorney/client relationship